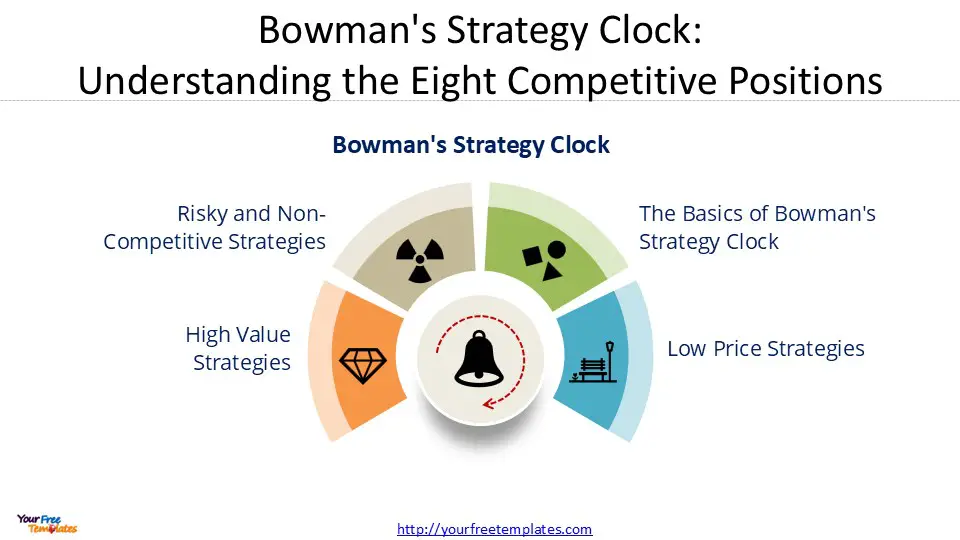

Bowman’s Strategy Clock is a powerful tool for businesses to understand and navigate competitive positioning. This model, developed by Cliff Bowman and David Faulkner, outlines eight distinct strategic options companies can adopt to gain a competitive advantage in their market. By analyzing factors such as price and perceived value, organizations can make informed decisions about their market strategy.

At the end of this post, you can download our Bowman’s Strategy Clock PowerPoint template to fit your purpose. As the same diagram PowerPoint template series, you can also find our Value Chain Analysis, Climate Change, Carbon Neutral Meaning, Renewable Energy Sources, Generative AI, Circular Economy, Blue Sea Strategy, 2025 Calendar with Holidays, The 7 Habits of Highly Effective People, Six Thinking Hats, Pareto Chart, Occam’s Razor, Data Mining, marketing segment, Porter’s five forces, SWOT Analysis, GE Matrix, BCG Matrix, Artificial Intelligence, National Diamond and BlockChain PowerPoint templates.

The Strategy Clock provides a framework to examine various approaches, from low-price strategies to high-value differentiation. It helps businesses to consider market segmentation, strategic positioning, and ways to build a competitive edge. As we explore each position on the clock, we’ll look at how companies can use these insights to shape their business strategies and respond to market dynamics. This understanding is crucial for managers and strategists aiming to boost their company’s performance in today’s complex business world.

The Basics of Bowman’s Strategy Clock

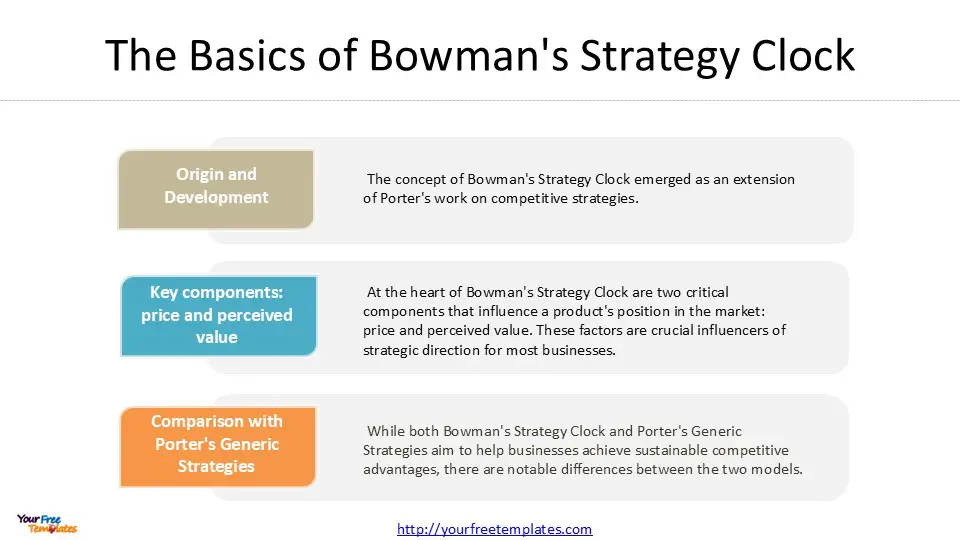

Bowman’s Strategy Clock, a powerful tool for strategic positioning, was developed by Cliff Bowman and David Faulkner in 1996. This model expanded on Michael Porter’s Generic Strategies, offering a more nuanced approach to competitive positioning in the marketplace. The Strategy Clock provides businesses with a framework to analyze and select the most suitable market strategy based on two key dimensions: price and perceived value.

Origin and development

The concept of Bowman’s Strategy Clock emerged as an extension of Porter’s work on competitive strategies. While Porter’s model outlined three generic strategies (Cost Leadership, Differentiation, and Focus), Bowman and Faulkner reimagined this concept and developed a more comprehensive approach. Their model, first published in 1997 in a paper titled “Competitive and Corporate Strategy,” expanded Porter’s three strategic positions to eight identifiable positions on a circular diagram .

Key components: price and perceived value

At the heart of Bowman’s Strategy Clock are two critical components that influence a product’s position in the market: price and perceived value. These factors are crucial influencers of strategic direction for most businesses. The model explores how different combinations of price and perceived value determine the likelihood of each strategy’s success.

The Strategy Clock demonstrates that most consumers only purchase a product when they believe its value matches its price. By adjusting these two components, businesses can arrive at the most competitive position in the market. This framework allows companies to experiment with various combinations to find the optimal strategy that leverages their competitive advantages and mitigates weaknesses .

Comparison with Porter’s Generic Strategies

While both Bowman’s Strategy Clock and Porter’s Generic Strategies aim to help businesses achieve sustainable competitive advantages, there are notable differences between the two models. Porter’s approach divides market size into broad and narrow categories and assumes that companies compete either on price or perceived value. In contrast, Bowman’s Strategy Clock offers a more detailed perspective on competitive positioning.

The Strategy Clock expands Porter’s three strategic positions (Cost Leadership, Differentiation, and Focus) to eight distinct options. This expansion provides a more comprehensive range of possibilities for businesses to position their products or services. By focusing on the value proposition to customers, Bowman’s model offers a more nuanced analysis of competitive positioning .

Bowman’s Strategy Clock is not only more comprehensive but also more flexible than Porter’s model. It allows businesses to consider a wider range of strategic options, including hybrid strategies that combine elements of low price and differentiation. This flexibility enables companies to adapt their strategies more effectively to changing market conditions and consumer preferences.

Low Price Strategies

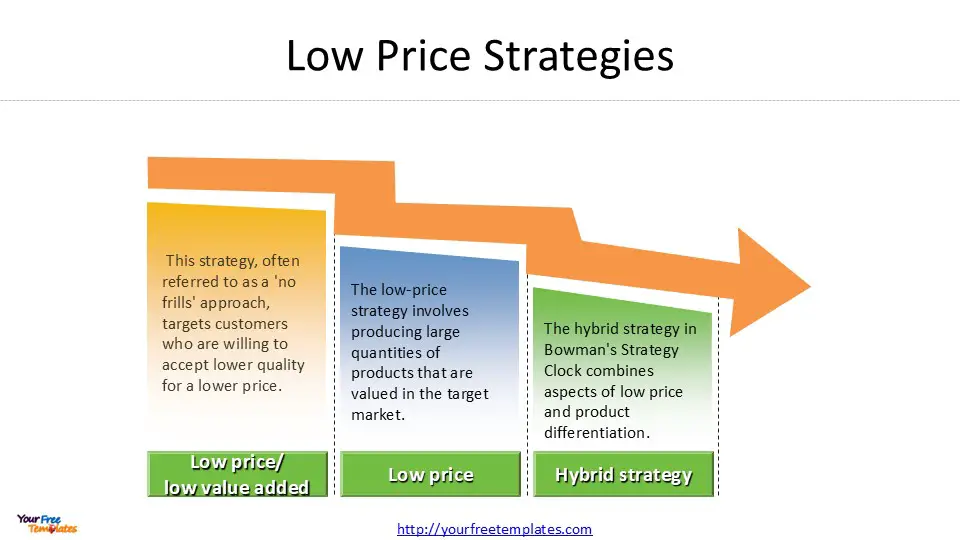

Low price strategies are crucial components of Bowman’s Strategy Clock, offering businesses ways to gain a competitive advantage through pricing. These strategies focus on attracting price-sensitive customers and increasing market share. There are three main approaches within this category: low price/low value added, low price, and hybrid strategy.

Low price/low value added

This strategy, often referred to as a ‘no frills’ approach, targets customers who are willing to accept lower quality for a lower price. Companies employing this strategy keep prices relatively low as their primary means of competing in the market. Products or services in this category are not distinguished, and customers perceive very little value. Despite the low prices, this position is not considered highly competitive within Bowman’s Strategy Clock framework.

An example of a company using this strategy is Dollar Tree, which sells most items for $1.00 or less. Their products, such as party supplies and decorative goods, are often disposable and of inferior quality. However, the attractive prices motivate customers to make occasional purchases. Companies in this position rely on high sales volumes to sustain their business, hoping that competitors won’t undercut their prices further.

Low price

The low price strategy involves producing large quantities of products that are valued in the target market. Companies following this approach aim to be cost leaders, focusing on minimizing expenses through fast and cheap production while leveraging economies of scale. Although profit margins on individual products are low, the high output volume can generate substantial profits.

JetBlue Airlines successfully implemented this strategy to expand its business. By offering even lower fares than Southwest Airlines, which was known for its low prices, JetBlue gained a competitive advantage over other airlines. This position often leads to price wars between competing brands as they strive to maintain or increase their market share.

Hybrid strategy

The hybrid strategy in Bowman’s Strategy Clock combines aspects of low price and product differentiation. This approach is highly effective when companies can consistently offer added value at reasonable prices. Businesses using this strategy focus on balancing product differentiation, which makes their offerings highly valued in the market, with competitive pricing.

Ikea has successfully implemented a hybrid strategy, building strong brand loyalty by offering higher perceived value at reasonable prices. Similarly, Lush Cosmetics differentiates itself through ethically made products at competitive prices. Their commitment to social and corporate responsibilities gives them an edge over rivals.

The hybrid model attracts consumers by offering products at lower or reasonable prices with some unique features that other brands don’t provide. Customers are convinced that they are getting good value for their money, which can enhance customer loyalty. This strategy can be particularly effective in markets where consumers are looking for a balance between price and quality.

In conclusion, low price strategies on Bowman’s Strategy Clock provide businesses with various options to compete based on pricing. Whether through a no-frills approach, cost leadership, or a hybrid model, companies can use these strategies to gain market share and establish a strong competitive position. The key to success lies in understanding customer preferences, market dynamics, and the ability to maintain profitability while offering attractive prices.

High Value Strategies

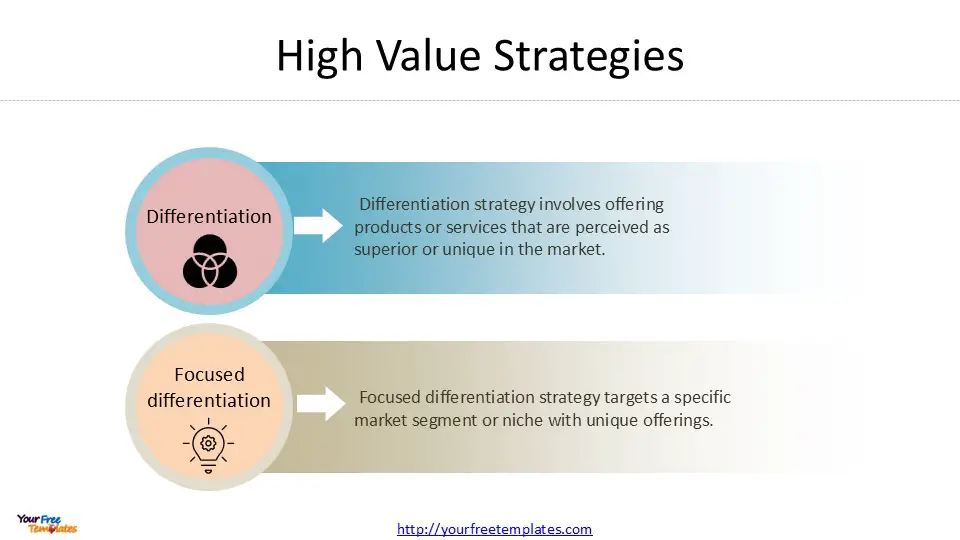

High value strategies on Bowman’s Strategy Clock focus on creating a unique value proposition for customers, allowing companies to command premium prices and establish a strong competitive advantage. These strategies emphasize differentiation and targeted market segmentation to maximize perceived value.

Differentiation

Differentiation strategy involves offering products or services that are perceived as superior or unique in the market. Companies employing this approach aim to create maximum perceived value for their customers. By differentiating their offerings, businesses can justify higher prices and build strong brand loyalty.

Apple serves as a prime example of a company successfully implementing a differentiation strategy. As a flagship for innovation, Apple periodically introduces innovative products and technologies to the market, maintaining its image as an industry leader. This approach allows Apple to charge premium prices for its products, as customers perceive them to be of higher quality and more innovative than competitors’ offerings.

Another example is Nike, known for its high-quality products and premium prices. Nike has built a strong brand identity and offers value-added services, which contribute to its successful differentiation strategy. By focusing on product quality, innovation, and brand image, Nike has established itself as a leader in the athletic footwear and apparel market.

Focused differentiation

Focused differentiation strategy targets a specific market segment or niche with unique offerings. This approach allows companies to cater to the distinct needs and preferences of a particular group of customers, often commanding even higher prices than broad differentiation strategies.

Luxury brands frequently employ focused differentiation strategies. For instance, Rolex watches are positioned as a luxury item, with high quality and brand image serving as key distinguishing features. Rolex targets a small market segment willing to pay a premium for the status associated with wearing their watches. This strategy allows Rolex to charge prices that are 10 to 25 times higher than more economical alternatives.

Similarly, brands like Christian Dior, Gucci, Louis Vuitton, and Rolls-Royce survive through targeted markets and high margins. These companies focus on creating products with high perceived value, often emphasizing design and exclusivity. Their strategy involves targeted advertising, PR campaigns, and carefully managed distribution to maintain their premium positioning.

Implementing high value strategies requires significant investments in product development, branding, and marketing capabilities. Companies must also develop the skills and competencies necessary for providing outstanding customer service. While these strategies can lead to substantial profits, they are often challenging to implement and maintain over the long term.

In conclusion, high value strategies on Bowman’s Strategy Clock offer companies the opportunity to create unique value propositions, command premium prices, and establish strong brand loyalty. By focusing on differentiation or targeted market segments, businesses can position themselves as leaders in their respective niches and achieve sustainable competitive advantage.

Risky and Non-Competitive Strategies

Bowman’s Strategy Clock also includes positions that are considered risky or non-competitive. These strategies can be challenging to maintain and may lead to a loss of market share if not carefully managed. Understanding these positions is crucial for businesses aiming to achieve a competitive advantage through strategic positioning.

Risky high margins

This strategy involves setting high prices without offering additional value to customers. Companies employing this approach rely on their strong brand name or temporary market imbalances to justify elevated prices. For instance, some gyms offer expensive memberships without providing significantly more value than their competitors . This strategy can yield high returns in the short term but is generally unsustainable in competitive markets.

Businesses using this approach must be cautious, as it can attract competitors or substitute products. Customers may eventually seek better value for their money, leading to a decline in sales. Companies should only consider this strategy if they can clearly articulate customer value or if they are using it as a short-term tactic to exploit temporary market conditions.

Monopoly pricing

Monopoly pricing occurs when a single business controls a product or service and its price. In this position, companies have less concern for perceived customer value or competitive pricing. Microsoft’s Windows operating system in the 1990s is a prime example of monopoly pricing. The company charged software developers unreasonable prices for patent licenses and information fees, leading to antitrust fines from the European Union .

While monopolies can set prices at their discretion, they are difficult to achieve and maintain. Regulatory bodies often intervene to break down monopolies and promote fair competition. Companies in monopolistic positions should remain vigilant about potential market changes and new entrants to avoid losing their advantage.

Loss of market share

This strategy is often associated with companies exiting a market or experiencing decline. It involves offering products with low perceived value at disproportionately high prices. Blackberry’s experience in the smartphone market illustrates this position. When Apple launched the iPhone in 2007, it drastically changed customer perceptions of smartphones. Blackberry failed to adapt, leading to a loss of perceived value and market share .

Companies in this position may be forced to lower prices as they become less profitable and lose customers. This strategy is generally considered the worst position on Bowman’s Strategy Clock and suggests that a company is either deliberately exiting a market or has failed to achieve the right price-value fit.

To avoid this position, companies must continuously monitor market trends, customer preferences, and competitive landscapes. Adapting to changing circumstances and maintaining a strong value proposition are crucial for preventing a loss of market share.

In conclusion, while Bowman’s Strategy Clock offers various competitive positions, the risky and non-competitive strategies highlight the importance of maintaining a balance between price and perceived value. Companies must carefully consider their strategic positioning to avoid falling into these challenging positions and to maintain a sustainable competitive advantage in their respective markets.

Conclusion

Bowman’s Strategy Clock offers businesses a powerful tool to analyze and shape their competitive positioning. By examining the interplay between price and perceived value, companies can pinpoint their current market stance and chart a course for future success. This model’s eight strategic options provide a comprehensive framework to consider various approaches, from low-price strategies to high-value differentiation, enabling businesses to make informed decisions about their market strategy.

Understanding and applying Bowman’s Strategy Clock has a significant impact on a company’s ability to navigate complex market dynamics and build a lasting competitive edge. Whether aiming to lead on price, differentiate through unique value propositions, or find a balanced hybrid approach, this model equips managers and strategists with the insights needed to boost their company’s performance. In the end, the Strategy Clock serves as a valuable compass to guide businesses through the ever-changing landscape of competitive positioning.

FAQs

What is Bowman’s Strategy Clock?

Bowman’s Strategy Clock is a framework created by Cliff Bowman and David Faulkner to analyze how businesses can position their products competitively. This model outlines various strategies based on different combinations of price setting and perceived value.

What criticisms have been made against Bowman’s Strategy Clock?

Critics of Bowman’s Strategy Clock point out that not all the positions outlined in the model are competitively viable. Specifically, positions 6, 7, and 8 are considered non-competitive because they involve pricing strategies where the cost exceeds the perceived value to the customer.

Which positions on Bowman’s Strategy Clock are viewed as non-competitive?

On Bowman’s Strategy Clock, positions 6 (mediocre), 7 (monopoly pricing), and 8 (loss of market share) are identified as non-competitive. These positions involve strategies where the product pricing does not align favorably with customer-perceived value.

What is the purpose of a differentiation strategy in Bowman’s Strategy Clock?

In Bowman’s Strategy Clock, a differentiation strategy (position 4) involves offering distinctive products or services at a higher price, aiming to stand out in the market. The focused differentiation strategy (position 5) targets specific niche markets with highly specialized products or services, also typically priced higher to reflect their unique value.

Looking for Premium maps, please visit our affiliate site: https://editablemaps.com/ or https://ofomaps.com/

Size:176K

Type: PPTX

Bowman’s Strategy Clock Template

Click the link to download it.

Aspect Ratio: Standard 4:3

Click the blue button to download it.

Download the 4:3 Template

Aspect Ratio: Widescreen 16:9

Click the green button to download it.

Download the 16:9 Template